Chengxin Lithium Group Co., Ltd. was established on December 29, 2001, with its registered office located in Chengdu and a registered capital of 915 million yuan. On May 23, 2008, the company was listed on the Shenzhen Stock Exchange (stock code: 002240, stock abbreviation: Chengxin Lithium), and it has over 40 wholly-owned subsidiaries, mainly located in Sichuan, Guangdong, Indonesia, Argentina, and Zimbabwe, with a workforce of over 4,900 people. As of the end of 2024, the company's total assets were 21.752 billion yuan, with net assets attributable to shareholders of the parent company amounting to 12.026 billion yuan, and a revenue of 4.581 billion yuan in 2024.

The company's main business is the production and sales of lithium minerals, basic lithium compounds, and lithium metal products, with its main products being lithium concentrates, lithium carbonate, lithium hydroxide, lithium chloride, and lithium metal.

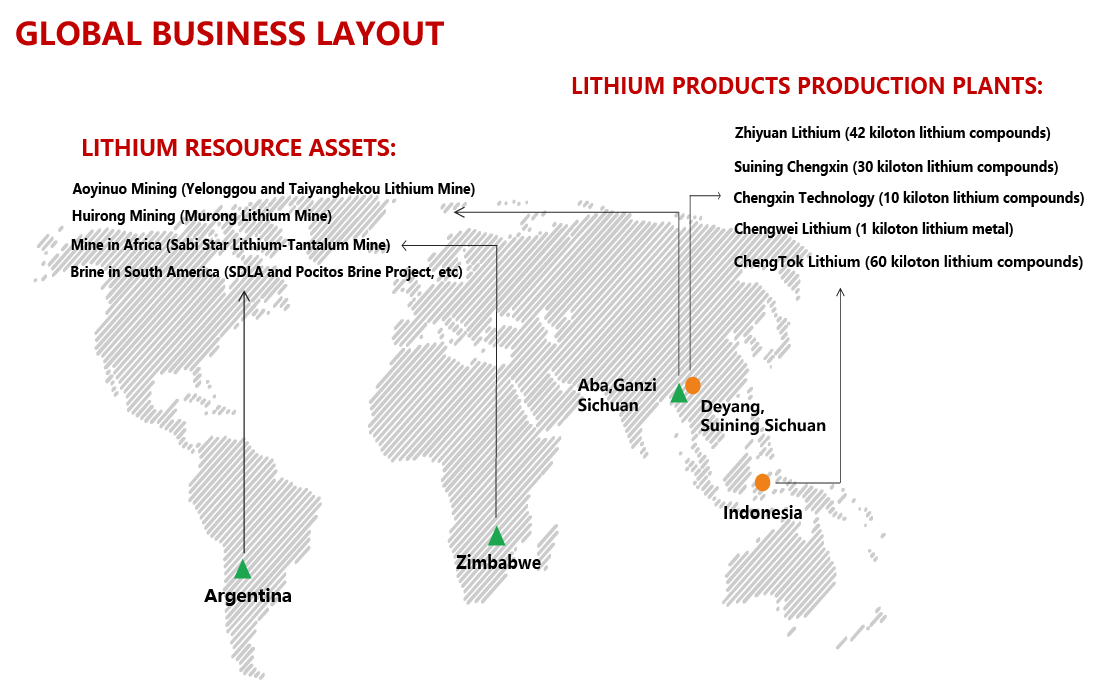

The company has established lithium compounds production capacities totaling 137,000 tons and a lithium metal production capacity of 500 tons in Deyang and Suining, Sichuan Province, as well as in Indonesia. Notably, the 60,000-ton-per-annum lithium compounds production base in Indonesia stands as the largest overseas ore-to-lithium project, placing the company's lithium salt production capacity among the world's foremost. Equipped with advanced and mature production technologies, the company possesses extensive experience in lithium research, development, production management, and profound professional expertise. Its key clients include industry-leading enterprises such as BYD, CALB, HITHIUM, LGES, SK On, POSCO, ALB, Hyundai, Hunan Yuneng, and Dynanonic.

The company has strategically deployed its lithium resources globally and boasts a professional team for mine development and construction. It has successfully developed the challenging Aoyinuo Mine in Jinchuan County, Sichuan Province, with an annual lithium concentrate output of approximately 75,000 tons. In Zimbabwe, the company operates the Sabistar Lithium Mine Project, which boasts an average ore grade of 1.98%, making it the highest-grade producing lithium mine in the region, with an annual lithium concentrate output of about 290,000 tons. The company has also invested in the Murong Lithium Mine in Yajiang County, Sichuan Province, which holds 989,600 tons of Li₂O resources with an average grade of 1.62%, ranking it as one of the highest-grade lithium mines in Sichuan, with a designed production scale of 3 million tons per annum, active development and construction efforts are underway. Additionally, the company holds independent operational rights to the SDLA brine project in Argentina and has invested in multiple brine exploration projects, including Pocitos and Arizaro.

With the rapid development of new energy vehicles and energy storage industries, the demand for lithium compounds has continued to grow, providing a huge market space and development opportunities for lithium products. The company's strategic goal is to "becoming a global leader company in lithium battery new energy materials", and it always maintains strategic persistence, continuing to increase investment in the lithium-ion new energy field while actively seeking high-quality lithium resources projects globally.

The company will focus on resource reserves in Sichuan, Africa, and Argentina and expand its resource reserves globally. It will also adjust its capacity planning according to the future market demand for lithium products and seize the industry development opportunities by focusing on "resources, scale, quality, and customers" in all its work. The company will enhance its resource reserves, expand its market scale, improve product quality, and serve global customers to contribute to the world's energy sustainable development with lithium.